Chapter 5:

Electricity Source Trends

Analysis of the different global electricity sources in 2022

The following pages run through a more detailed analysis of the changes in supply of electricity in 2022, and over a longer-term trend.

We have ordered the sections according to the fastest growing sources of electricity.

Solar

Solar power produced 4.5% (1,284 TWh) of global electricity in 2022. China generated the most electricity from solar at 418 TWh (4.7% of its electricity mix), while Chile had the highest percentage of solar in its electricity mix (17%, 14 TWh) ahead of the Netherlands (15%, 18 TWh) and Australia (13%, 33 TWh).

Role of solar in net zero

Solar provides clean power that can be deployed quickly and locally to the demand source. As such, together with wind, it will form the backbone of the future electricity system by providing nearly 70% of global electricity by 2050. New solar power produces the cheapest electricity in history, according to the IEA.

Change in 2022

Global solar electricity generation rose by 24% (+245 TWh), from 1,039 TWh in 2021 to 1,284 TWh in 2022. This was the 18th year in a row that solar was the fastest growing electricity source by year-on-year percentage change. Solar’s share in the global electricity mix grew by 0.8 percentage points, from 3.7% in 2021 to 4.5% in 2022.

The global rise in solar power was driven by a significant rise in China (+91 TWh, +28%) accounting for 37% of the worldwide increase. Solar generation increases in the US (+41 TWh, +25%) accounted for a further 17% of the global rise. Other regions with notable increases include the EU (+40 TWh, +24%), India (+27 TWh, +39%) and Japan (+10 TWh, +11%).

Solar generation more than doubled from 2021 in Kenya, Lithuania and Poland. The few countries with falling solar generation only recorded small falls of less than 10% (South Africa -6.6%, Switzerland -6.6%), caused by weather conditions rather than structural changes.

Long-term trend

Over the last two decades, solar generation has gradually increased to become a significant part of the global electricity mix. In 2000, solar generated only 1.1 TWh. By 2022, it had increased to 1,284 TWh. As a result, the share in the electricity mix has shot up from 0.01% in 2000 to 4.5% in 2022.

Most solar growth has occurred in the last few years. During early years of deployment, solar increased from near zero in 2000 to 255 TWh in 2015. At this point, it had reached a market share of 1.1%. Although the absolute increases were still relatively small, this growth equated to a relatively high annual growth rate of 44%.

Since the Paris Agreement in 2015 we have seen absolute increases accelerate, getting bigger every year. The broad and fast-paced adoption of solar worldwide means that solar grew by 1,029 TWh in this period. The annual growth rate slowed to 26% during 2015-2022, but solar still represents the fastest-growing source of electricity. 2022 saw a year-on-year increase of 24% (+245 TWh). Since the Paris Agreement in 2015, solar’s market share has grown to 4.5%, with growth across all G20 countries.

Progress towards net zero

Solar generation needs to rise to 7,552 TWh by 2030 to keep global heating to 1.5C, as per the IEA Net Zero Emissions scenario. The pathway requires solar to grow by 25% annually from 2021 to 2030, and would see solar’s share of global electricity generation reach 20% in 2030, up from 4.5% currently.

To align with the net zero pathway, solar power therefore needs to sustain the rate of growth seen between 2015 and 2022. This would mean increasing by 25% every year throughout the rest of the decade. To achieve this growth, countries need to continually increase their annual solar deployment targets. For example, in 2023 this would require 318 TWh in additional solar generation, while in 2030 the world would need to be adding at least 1,500 TWh of solar generation annually.

Wind

Wind power produced 7.6% (2,160 TWh) of global electricity in 2022. China was the biggest generator of wind power at 824 TWh, (9.3% of its electricity mix), while Denmark had the highest wind generation by percentage share at 55% (19 TWh). Germany had both the third highest generation of any country (126 TWh) and the sixth highest share in the mix at 22%.

Role of wind in net zero

Wind generation, alongside solar, is key to reducing emissions in the electricity sector. Both sources will form the backbone of the future electricity system by providing nearly 70% of global electricity by 2050. Therefore, rapid scale-up is required this decade.

Change in 2022

In 2022, wind was the electricity source with the largest absolute increase. Global wind electricity generation increased by 17% (+312 TWh), from 1,848 TWh in 2021 to 2,160 TWh in 2022. Only solar recorded higher relative growth. Wind’s share in the global electricity mix also grew by one percentage point, from 6.6% in 2021 to 7.6%.

Wind power growth in China accounted for more than half of the global increase (+168 TWh, +26%). However, wind power rose across the globe. The US (+56 TWh, +15%) and the EU (+34 TWh, +8.8%) recorded significant increases in wind generation, and so did the UK (+15 TWh, +23%), Brazil (+8.5 TWh, +12%) and Viet Nam (+6.3 TWh, +262%) among many others.

Ukraine experienced a decline in wind generation due to the impact of the war, with much of its wind capacity in regions affected by hostilities, according to the Ukrainian Association of Renewable Energy. Only a few other countries with very low levels of wind generation had declines.

Long-term trend

Wind generation has increased rapidly in the last two decades. In 2000, wind generation was 31 TWh with a global share of power of only 0.2%. In 2022, wind generation was 2,129 TWh higher, reaching 2,160 TWh. Consequently, the market share has increased to 7.6%.

Similar to solar generation, wind generation has accelerated dramatically in recent years. Between 2000 and 2015, generation grew at a relatively high annual rate of 24%. However, absolute increases remained small, with wind generation reaching 828 TWh and a 3.5% share of global generation in 2015. Since then, absolute growth has increased significantly, to add an additional 1,332 TWh in just seven years. Relative growth has slowed, with wind generation recording an annual growth rate of 15% during this period. 2022 saw slightly higher growth, with wind generation increasing by 17% (+312 TWh).

Remarkably, wind’s market share has grown in all G20 countries during that period. In Germany and the UK, wind power now accounts for over 20% of generation (22% and 25% respectively) and is even higher for smaller countries like Denmark (55%), Ireland and Uruguay (both 33%).

Progress towards net zero

For a 1.5C power sector pathway, wind generation needs to increase to 7,840 TWh by 2030, as per the IEA Net Zero Emissions scenario. This would require an increase of 17% per year from 2021 to 2030, reaching 21% of global generation. In 2022, wind achieved this growth rate, but from 2015 to 2022, average yearly growth was slightly lower at 15%.

Hydro

Hydro power produced 15% (4,311 TWh) of global electricity in 2022. China produced the most electricity from hydro, at 1,318 TWh (15% of its energy mix), while Paraguay had the highest percentage share of hydro in its electricity mix (99.7%, 40 TWh). Hydro dominated the electricity system of some major electricity producers: Brazil produced 63% (428 TWh), Canada 61% (392 TWh) and Norway 88% (130 TWh) from hydro.

Role of hydro in net zero

Hydro power has an important role in the global electricity mix. Not only is it currently the largest source of clean power, but it also provides flexibility to help accommodate the large influx of wind and solar. The world needs new hydro power plants, but in many regions hydro resources have already been maximised. In other regions where there is potential, the projects may come at too high an ecological and social cost.

Change in 2022

Global hydro electricity generation rose by 1.7% (+73 TWh), from 4,238 TWh in 2021 to 4,311 TWh in 2022. Due to strong demand growth, the share of hydro in the overall electricity mix fell by 0.1 percentage points, from 15.2% in 2021 to 15.1%.

Hydro rebounded in 2022, after a fall in 2021 for the first time in over a decade. Hydro still remains below the record-high generation seen in 2020 (4,340 TWh).

In 2022, the global increase was driven by increases in Brazil (+65 TWh, +18%), Viet Nam (+25 TWh, +33%), China (+18 TWh, +1.4%), Canada (+15 TWh, +3.9%), as well as increases in India (+14 TWh, +8.9%) and Türkiye (+11 TWh, +20%). However, many European countries were hit by historic droughts in the summer, causing hydro output to fall dramatically. The EU as a whole saw hydro generation fall by 66 TWh (-19%). Russia’s hydro generation also fell substantially, by 19 TWh (-8.9%). Southern Europe was hit hardest with generation falling the most in Italy (-15 TWh, -34%), France (-13 TWh, -23%) and Spain (-11 TWh, -37%).

Long-term trend

Hydro generation has increased substantially over the last two decades, with stable growth (+1,690 TWh). However, its share in the electricity mix has fallen from 18% in 2000 to 15% in 2022, as its growth has not kept pace with rising electricity demand.

Since the Paris Agreement in 2015, the average year-on-year growth in hydro has been 1.6%. This is less than the annual growth rate from 2000 to 2015 of 2.6%. Hydro’s share has fallen from 16% to 15% of global electricity generation since 2015. In most of the G20 countries, market share has remained stable or fallen. Only in Australia, Canada, South Korea, Russia and South Africa has the share of hydro generation in power increased since 2015.

Progress towards net zero

Hydro generation needs to rise by 3.2% annually between 2021 and 2030 according to the target outlined in the IEA Net Zero Emissions scenario. This would maintain hydro’s share of global generation at the current level. Since 2015, the average year-on-year growth for hydro power has been 1.6%. Therefore, to align with the net zero pathway, growth in hydro power would need to happen twice as fast.

Given that recent years have seen hydro generation in some regions affected by extreme weather, this rate of growth could present a challenge in years with heat waves and droughts. The IPCC notes the uncertainty around hydro conditions with some regions. Southern Europe, Australia and the southern United States among other regions could see generation drop by 20%, whereas other regions like India or northern Europe might experience an increase in hydro output. New solutions may mitigate this risk, such as floating solar panels, which can reduce evaporation and maximise hydro electricity generation.

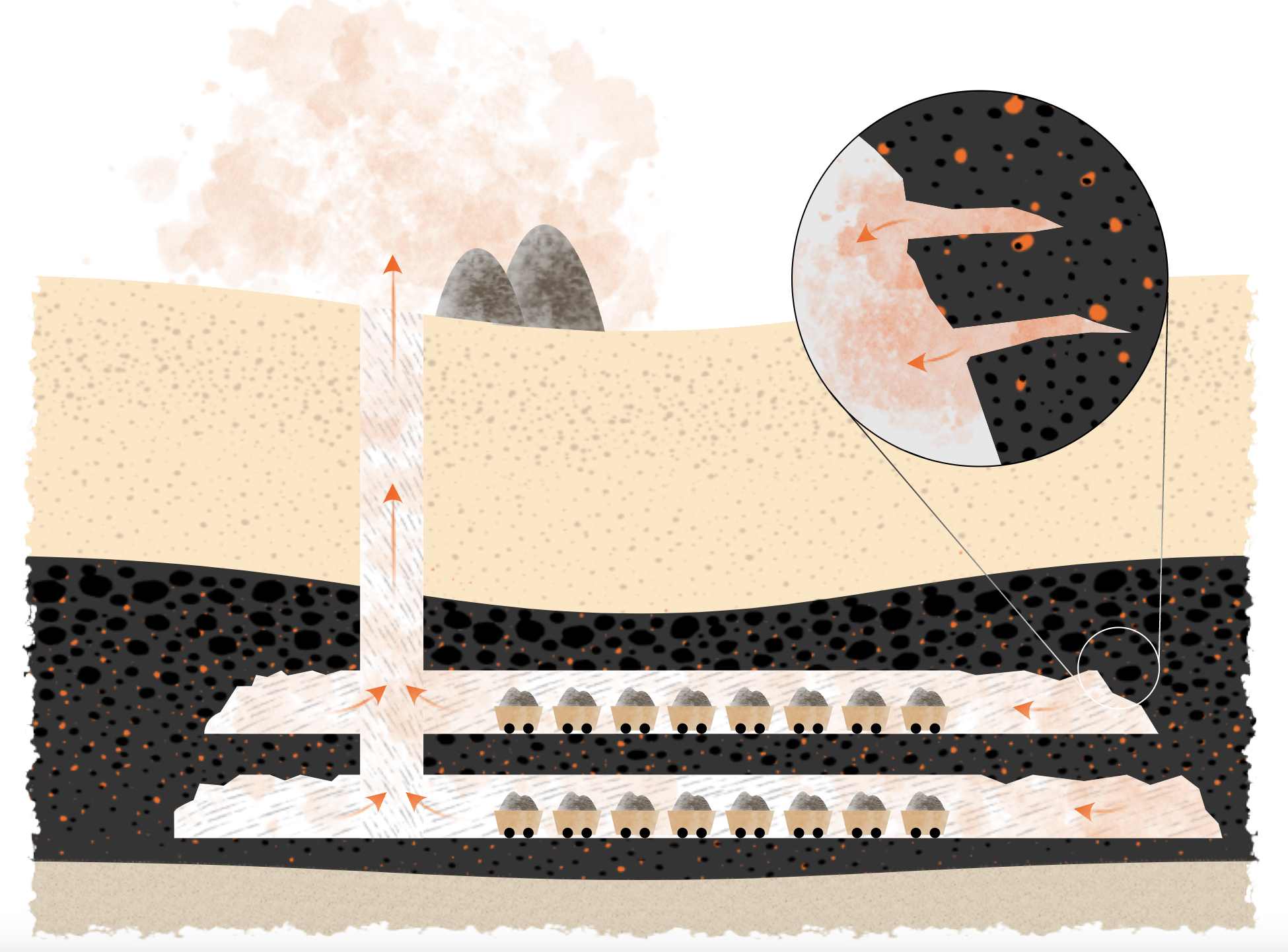

Coal

Global coal power generation reached an all-time record high of 10,186 TWh in 2022, producing 36% of global electricity in 2022. China produced by far the most electricity from coal of any country, generating 5,420 TWh of coal power (61% of its electricity mix). This is four times more than the second largest, India, at 1,363 TWh (74% of the mix). Kosovo had the largest share of coal in the power mix at 94% (10 TWh).

Role of coal in net zero

Coal is the single largest contributor to emissions from the power generation sector. As such, its role has to be reduced rapidly in the next two decades so the world has a chance to limit global warming to 1.5C. As per the IEA Net Zero Emissions scenario, unabated coal plants need to be phased out by 2030 in advanced economies and by 2040 in developing ones.

Change in 2022

Coal generation rose by 1.1% (+108 TWh), from 10,078 in 2021 to 10,186 TWh in 2022. Although coal generation hit a record high, the share of coal generation dropped by 0.5 percentage points in 2022, down to 35.7% from 36.2% in 2021. This fall in share can be attributed to significant growth in wind and solar (+19%, +557 TWh).

Despite the record generation, coal’s growth of 1.1% was much smaller than in 2021, when coal saw an increase of 8.4% as world economies eased Covid-19 restrictions.

Extreme temperatures in summer and winter pushed up power demand, driving monthly coal generation up. The largest increase was in August (+7.3%, +66 TWh). The largest increase came from India (+92 TWh), China (+81 TWh) and Germany (+17 TWh). Kosovo, Mexico, Spain and Italy had annual increases higher than 50%. The US showed the largest fall in coal generation (-70 TWh), followed by Viet Nam (-15 TWh). New Zealand and Portugal almost halted coal generation in 2022, showing yearly drops of 94% and 93%, respectively.

Long-term trend

Over the last two decades, coal generation increased by 78%, from 5,719 TWh in 2000 to 10,186 TWh in 2022. However, the share of coal in the global power mix has fallen slightly (from 38% in 2000 to 36% in 2022). No other individual fuel source is larger than coal, though clean sources in aggregate exceeded coal generation in 2019.

Since the Paris Agreement, the rate of coal generation’s annual growth has slowed, with an average growth rate of 1.5% from 2015 to 2022, half the average rate between 2000 and 2015 (+3.2%). From 2000 to 2015, the share of coal power in the electricity mix increased by one percentage point (from 38% to 39%). In 2022, the share had fallen to 36%.

Among G20 countries, South Africa has had the highest share of coal generation since 2015, followed by India as the second highest and China the third, showing no change in ranking. Most G20 countries have dropped their share of coal by varying degrees. The UK has had the largest fall in coal share, with a decrease from 23% in 2015 to 1.6% in 2022.

Progress towards net zero

According to the IEA Net Zero Emissions scenario, the world needs to bring the share of coal in the power mix down to 12% by 2030, a decrease of 24 percentage points from the share in 2022 (36%). The IEA pathway requires coal to decline 8.3% every year from 2021 to 2030, whereas since 2015 coal has increased by 1.5% annually. To meet the requirements of the IEA pathway, OECD countries will need to phase out coal by 2030, with the rest of the world following by 2040.

Bioenergy

In 2022, 2.4% (672 TWh) of global electricity was generated with bioenergy. China was the largest producer, generating 172 TWh (1.9% of its electricity mix), followed by Brazil (57 TWh, 8.5% of the mix). Countries that relied on bioenergy the most were Finland (19% of total generation, 14 TWh) and the United Kingdom (11%, 35 TWh).

Role of bioenergy in net zero

Although bioenergy is categorised as a renewable source in this report, its climate impact is highly dependent on the type of feedstock and how it was sourced. Scientific evidence is mounting that suggests that in some cases burning bioenergy for power contributes to climate change.

Change in 2022

Bioenergy production slightly increased by 0.8% (+6 TWh), up from 666 TWh in 2021 to 672 TWh in 2022. This was the lowest annual absolute increase for bioenergy since 2001. The share of bioenergy in the global electricity mix remained unchanged at 2.4% in 2022.

The UK had the largest fall in absolute terms (-4.1 TWh), followed by the US (-1.9 TWh), and the Netherlands (-1.1 TWh). The decrease in the UK is particularly notable, as it was the first year that bioenergy production fell since 2000. The drop was also quite large in relative terms (-10%), dropping the share of bioenergy in the UK’s power mix from 13% 2021 to 11% in 2022.

On the other hand, Japan increased production by 7.2 TWh (+19%), as it experienced annual power demand growth above 1% for the first time since 2010. South Korea also increased production, adding 3.6 TWh of bioenergy to the power mix (+24%) to meet rising demand while decreasing reliance on coal.

Long-term trend

In the last two decades, bioenergy generation has increased 4.5 times, from 148 TWh in 2000 to 672 TWh in 2022. Consequently, the share of bioenergy in the global power mix went from below 1% in 2000 to 2.4% in 2022. There has been only one calendar year when bioenergy generation showed an annual decline: in 2001 production fell by 5.5 TWh (-3.7%). Since then, bioenergy generation has grown at an average annual growth rate of 8%. In 2022, the growth rate plummeted to 0.8%, as major producers like Brazil, United States and the UK reduced bioenergy generation.

Growth of bioenergy generation has slowed since 2015, showing a lower average annual growth rate at 4.9%. Bioenergy’s share has gone up only by 0.4 percentage points since 2015, from 2% to 2.4% in 2022.

Among G20 countries, the UK has the highest share of bioenergy in the domestic power mix. In 2000, its share was only 1.1%. By 2015, the share rose to 8.5%, although the increase has slowed, bringing the UK’s share of bioenergy to 11% in 2022. Brazil and Germany have similar shares, with a consistent share of around 8% since 2015.

Progress towards net zero

Because of the climate risks associated with carbon-intensive feedstock, bioenergy should play a limited role in clean electricity transition. In the IEA Net Zero Emissions scenario, bioenergy generation only accounts for 4% of global electricity generation in 2030. The International Panel on Climate Change suggested that bioenergy should be limited further to just 2% by 2040. Yet, the IEA Net Zero pathway suggests that bioenergy generation should double to 1,442 TWh by 2030 as the world phases out coal. To be on this pathway, global bioenergy generation would need to rise 7.6% every year from 2021 to 2030 compared to a growth rate of 4.9% since 2015.

Gas

Fossil gas generation is the second largest source of electricity worldwide, responsible for 22% of global electricity generation in 2022. The US was the largest producer of electricity from gas at 1,695 TWh (39% of its electricity mix). This is more than three times larger than the next biggest generator Russia (479 TWh, 43% of its mix). Kuwait had the highest share of gas in the mix, with 99.9% (71 TWh) of its electricity from gas.

Role of gas in net zero

Gas, after coal, is the second largest contributor to emissions from the power sector. In the mid-term it has a role helping with the power system flexibility to accommodate a large influx of wind and solar. However, unabated gas (gas without carbon capture and storage) will need to be phased out by 2040 in order to move to a clean power system.

Change in 2022

Despite supply chain disruptions after Russia’s invasion of Ukraine and consequent price hikes, gas generation had only a marginal change. Down by 0.2% (-12 TWh), gas generation went from 6,348 TWh in 2021 to 6,336 TWh in 2022. The share of gas also decreased marginally from 23% in 2021 to 22% in 2022.

In the US, gas had a large increase of 116 TWh (+7.4%), driven by a rise in demand and a move away from coal. Some countries in western Europe also increased gas generation, with reduced nuclear generation in France forcing a 9.6 TWh (+29%) domestic increase, and the Iberian mechanism allowing Spain’s generation to rise by 15 TWh (+22%) to export power to France.

Reasons for declines elsewhere were mixed. Brazil had a 42 TWh fall in gas (-46%), driven by a resurgence of hydro after a poor year in 2021. In Türkiye, many other sources of power increased, most notably hydro and coal, allowing gas to fall by 35 TWh (-32%).

Long-term trend

In the last two decades, gas generation has increased 2.3 times, from 2,718 TWh in 2000 to 6,336 TWh in 2022. In 2022, gas generation reached its second highest ever level, not far from the 2021 record of 6,348 TWh. The share of gas went up from 18% in 2000 to 23% in 2015, then slightly down to 22% in 2022.

Over the past two decades, only three calendar years saw a drop in gas generation: 2013 (-2.1%, -105 TWh), 2020 (-0.8%, -50 TWh) and 2022 (-0.2%, -12 TWh). The fall in gas generation in 2022 was not as substantial as the two other years, but this hints at impacts from the global gas crisis.

From 2000 until the Paris Agreement in 2015, gas generation doubled, reaching 5,463 TWh in 2015. This translates to an average yearly growth rate of 4.8%. Since 2015, the rate of growth has slowed to 2.1% per year on average.

Half of the G20 countries have increased the share of gas in their power mix since 2015. Saudi Arabia is most notable, with the share of gas increasing from 46% in 2015 to 61% in 2021. Italy’s gas share went from 39% in 2015 to 51% in 2022, Germany from 9.9% to 17%, France from 3.7% to 9.2%, the US from 33% to 40%, and South Korea from 22% to 28%. On the other hand, Brazil’s gas share fell from 13% in 2015 to 7% in 2022, Türkiye’s from 38% to 23%, India’s from 4.9% to 2.7%, Japan from 40% to 34% and Russia from 49% to 43%.

Progress towards net zero

According to the IEA Net Zero Emissions scenario, the world must reduce gas generation to bring the total down to 4,977 TWh by 2030 to limit global temperature rise to 1.5C. Under this scenario, gas would account for 13% of the global power mix in 2030. To be on this path, gas generation must fall by 3% every year from 2021 to 2030.

Historically, gas generation has grown steadily, although its rate of growth has slowed since 2015. The gas crisis in 2022 may prove a turning point, as it revealed vulnerabilities of the global gas supply chain and prompted many countries to reconsider the role of gas in their power mix. If clean electricity growth accelerates, it has the potential to hasten the decline of gas in future years.

Nuclear

In 2022, nuclear power produced 9.2% (2,611 TWh) of global electricity. The US was the single largest nuclear power generator, accounting for 30% of global nuclear power production (772 TWh). Nuclear production in China was less than half that of the US, amounting to 418 TWh and 16% of global production. Countries that rely heavily on nuclear power are France (63%, 298 TWh), Slovakia (59%, 16 TWh), Ukraine (58%, 65 TWh), Belgium (47%, 44 TWh) and Hungary (45%, 16 TWh).

Role of nuclear in net zero

Nuclear power is an important source of firm zero-carbon energy, given the severity of the climate crisis and the necessity to quickly move off fossil fuels. Nuclear power capacity needs to increase significantly over the coming decades in line with growing electricity demand, but its share of global electricity generation is likely to remain similar to today.

Change in 2022

Global nuclear electricity generation fell by 4.7% (-129 TWh), from 2,739 TWh in 2021 to 2,611 TWh in 2022. Nuclear’s share in the global electricity mix also fell by 0.7 percentage points, from 9.9% in 2021 to 9.2% in 2022.

The largest fall occurred in France, where many nuclear power plants were shut down for maintenance for longer than expected (-82 TWh, -22%). The second largest fall came from Germany’s delayed nuclear phaseout (-47%, -33 TWh). The invasion of Ukraine forced several reactor shutdowns (-21 TWh, -25%). Among non-European countries, Japan had the largest fall in nuclear generation due to scheduled maintenance (-9.5 TWh, -15%), despite its shift in policy to revive its nuclear industry.

Among countries that saw a jump in nuclear generation, South Korea had the largest increase of 18 TWh (+12%). China’s nuclear generation went up by 10 TWh (+2.5%), with Honyanhe 6 nuclear reactor coming online in May. Pakistan had the third largest increase in absolute terms and largest percentage change globally (+6.7 TWh, +43%).

Long-term trend

In the last two decades, nuclear power has not seen significant growth. From 2000 until 2022, nuclear power increased only at about 0.2% annual growth rate on average. Nuclear share has gone down significantly as a result, dropping to 9.2% (2,611 TWh) in 2022 from 17% of the world’s electricity (2,507 TWh) in 2000.

The fall in nuclear power in 2022 (-4.7%, -129 TWh) was the second largest year-on-year decrease the world has ever seen. Nuclear generation in 2022 (2,611 TWh) was even lower than 2020 (2,635 TWh), when the Covid-19 pandemic forced the world economy to a halt. The largest drop was seen in 2012 (-6.7%, -172 TWh), a year after the Fukushima nuclear disaster struck Japan.

After the large setback in 2012, nuclear generation regained momentum of growth for the next seven years until 2020, the year when the Covid-19 pandemic began. However, growth was still not strong enough to keep pace with rising global power demand. As a result, the share of nuclear in the global electricity mix has declined. In 2015, the share of nuclear power was at 11% and it has continued to fall, reaching 9.2% in 2022.

Among G20 countries, France has the highest share of nuclear power in its domestic power mix. France also showed the largest drop in the share of nuclear power, decreasing its share from 76% in 2015 to 63% in 2022. The drop in nuclear power reflects strong uptake of wind and solar as well as gas. South Korea, which has the second highest nuclear share amongst the G20, has seen a slight fall, down from 30% in 2015 to 28% in 2022.

Progress towards net zero

According to the IEA Net Zero Emissions scenario, nuclear power will play a limited role in the global power mix in 2030, keeping its share at about 10%. Yet, to meet the world’s rising demand for power with zero-carbon energy source, the IEA pathway requires nuclear generation to grow by 3.8% annually from 2021 to 2030. From 2015 to 2022, the average growth rate was at just 0.6% and 2022 showed a 4.7% fall.