About

The report analyses Ember’s monthly electricity generation data for the European Union, calculating the potential cost saving in avoided fossil gas imports as a result of the increase in solar power in summer 2022.

The EU generated a record 12% of its electricity from solar from May to August 2022, helping to avoid a potential €29 billion in fossil gas imports.

Europe is currently facing an energy crisis of unprec edented proportions. Dwindling fossil fuel supplies are pushing electricity prices into all-time highs, with the power balance impacted further by nuclear reactor unavailability in France and drought limiting hydroelectricity generation across Europe, among others. It is at this time that solar energy truly shined, delivering record-high generation across the summer of 2022, helping keep the lights on and reducing the EU’s now critical gas consumption.

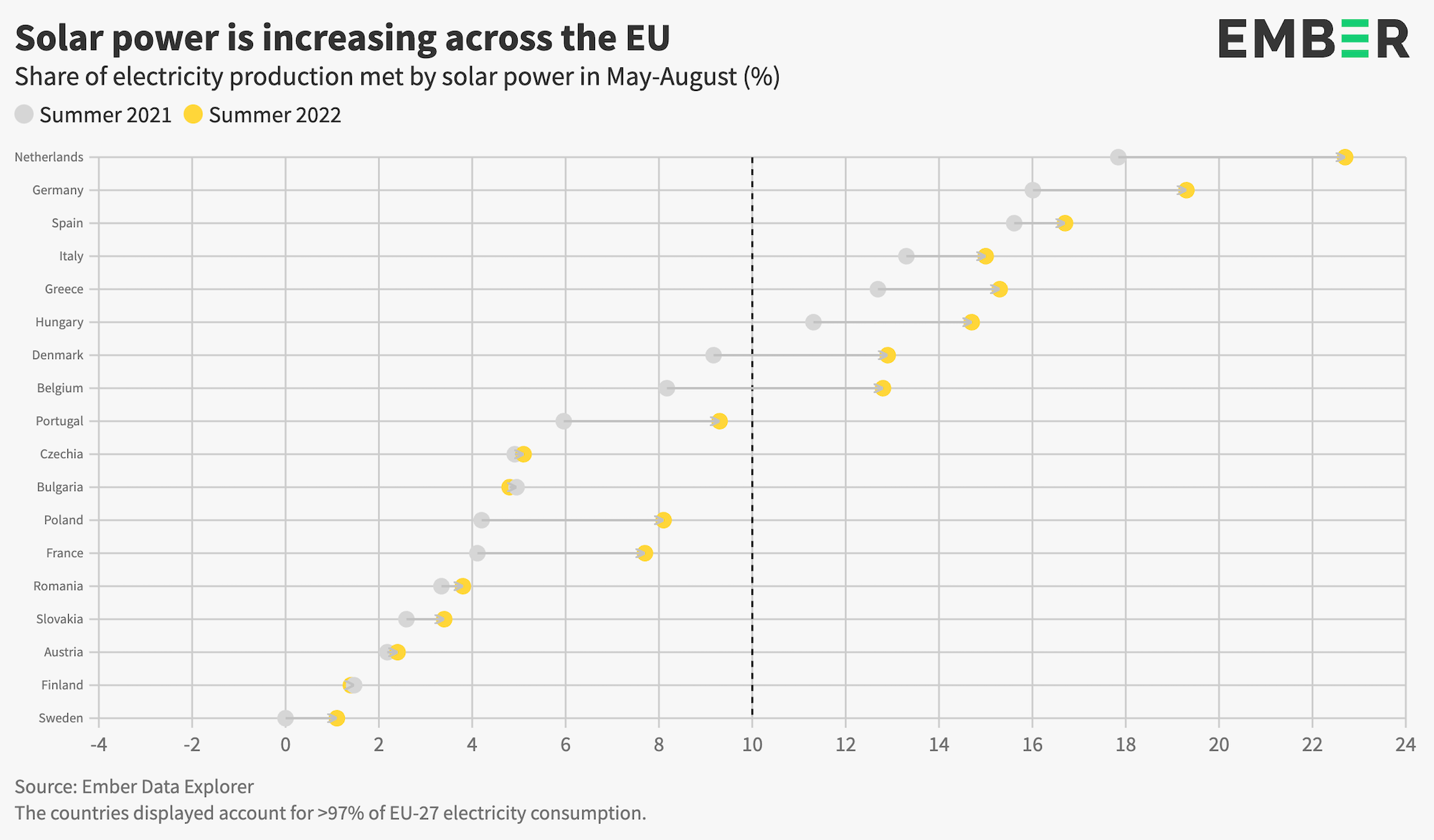

From May to August, the EU generated a record 12% (99.4 TWh) of electricity from solar power – up from 9% (77.7 TWh) last summer. Solar surpassed the share of wind (12%) and hydro (11%) in the power mix and was not far from coal’s 16%.

Without the record 99 TWh of solar generation over the past four months, the EU would have had to purchase another 20 bcm of fossil gas. Based on the daily gas prices for May to August, this equates to avoided gas costs of €29 billion.

Solar share records were broken in 18 out of 27 EU countries. The largest increase in solar generation since 2018 was in Poland, which increased solar generation 26 times, followed by 5-fold increases in Finland and Hungary. 10 EU Member States generated over a tenth of their electricity from solar panels during the summer of 2022. The highest share was in the Netherlands (23%), followed by Germany (19%) and Spain (17%).

The summer of 2022 is a clear indicator of the importance of solar energy in Europe’s power mix. While the recent records are clearly positive, the EU needs to make an even bigger push towards 2030, reducing permitting barriers, and increasing funding and solar deployment speeds. This is essential not only for climate targets but, perhaps most of all, for the security of the continent.

During the peak summer months of May-August, the EU generated 99.4 TWh of solar electricity – a 28% increase from 77.7 TWh the year before. Solar power was responsible for a record 12.2% of all electricity generation – up from 9.4% last summer, exceeding the share of wind (11.7%) and hydro (11%) in the power mix and just four percentage points shy of coal’s 16.5% share.

Solar’s growth is also accelerating: the 22 TWh rise between May-August 2021 and 2022 is much higher than the year-on-year change in 2021 (+8 TWh), 2020 (+10 TWh) and 2019 (+2 TWh). This is largely thanks to the consistent 15% year-on-year increases in installed solar capacity – from 104 GW in 2018 to 162 GW in 2021, with 23 GW added in 2021 alone.

In order for solar capacity and generation to match necessary ambition by 2030 — as well as REPowerEU targets — this rate of deployment must continue. However, Ember’s recent analysis shows that projections for the upcoming years fall short of the goal, with annual capacity additions in 2026 meeting only 46% of the value required under 1.5C pathways. This is largely due to permitting bottlenecks, with several countries exceeding the legally binding limits of project development times – these barriers need to be addressed for solar to keep growing.

Eighteen EU countries set a new solar record share during the summer peak this year: Austria (2.4%), Belgium (12.8%), Cyprus (13.3%), Czechia (5.1%), Denmark (12.9%), Estonia (13.9%), France (7.7%), Germany (19.3%), Greece (15.3%), Hungary (14.7%), Italy (15.0%), Netherlands (22.7%), Poland (8.1%), Portugal (9.3%), Romania (3.8%), Slovakia (3.4%), Slovenia (3.1%), Spain (16.7%).

Two new EU countries broke the 10% solar share mark – Belgium and Denmark, bringing the total number of countries generating a tenth of their electricity or more from the sun up to 10.

Note: Croatia, Latvia, Lithuania and Luxembourg were excluded from the solar share in generation analysis due to electricity imports exceeding 30% of the demand, Sweden was excluded due to no pre-2022 data being reported.

The largest increase in terawatt hours of solar generation since 2018 was in Poland, which increased solar generation 26 times, followed by 5-fold increases in Finland and Hungary, and 4-fold rises in Lithuania and the Netherlands.

In terms of the largest share of solar, the Netherlands is leading the race for the second year in a row, scoring a 23% solar share in the power mix – significantly above the 18% value in 2021, and well ahead of Germany (19%) and Spain (17%). It is notable that the Netherlands is the highest in the EU, despite modest irradiation as a more northerly country. This can be attributed to the Netherlands’ 30% increase in installed capacity in 2021 (11 to 14 GW).

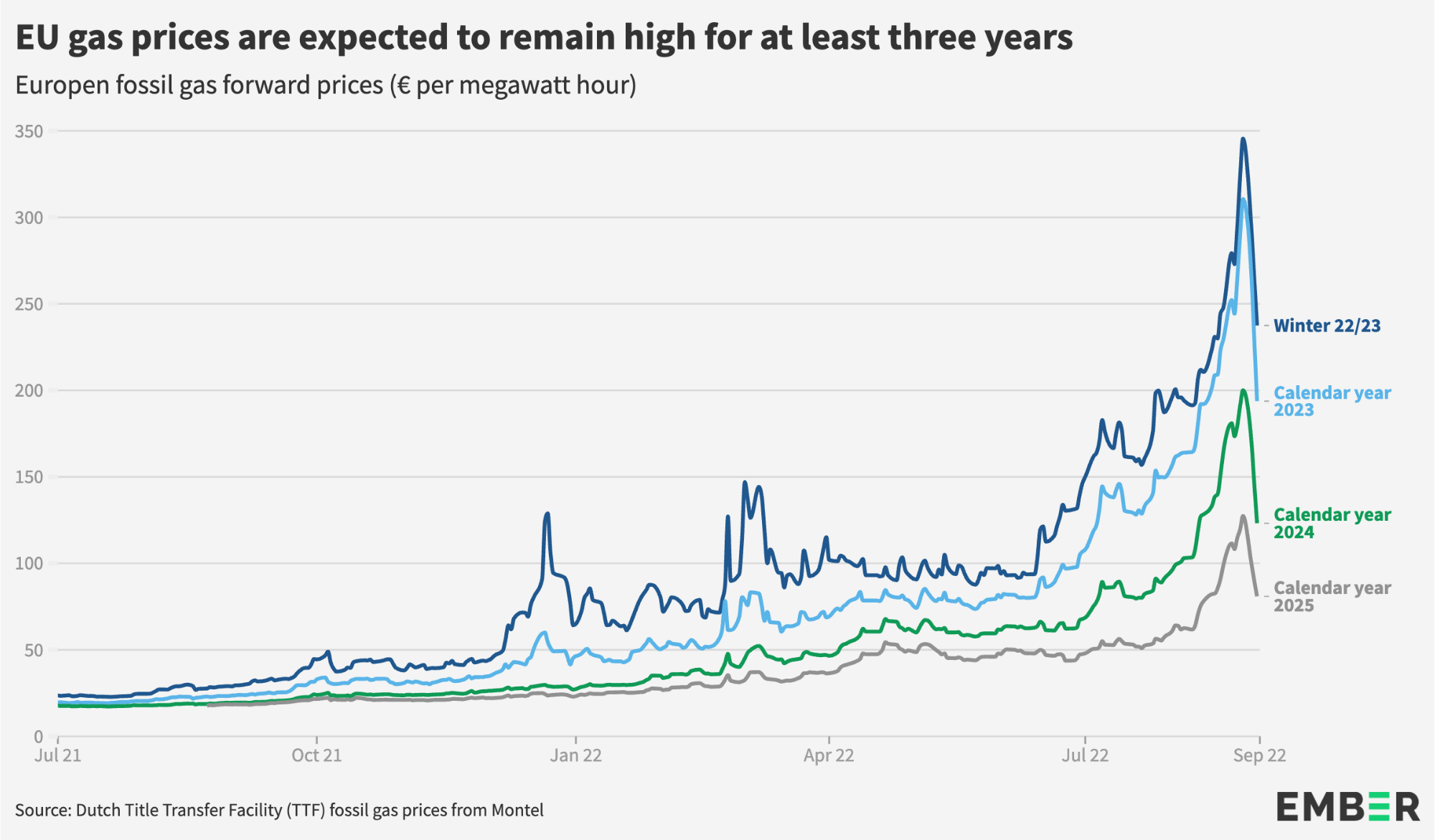

The war in Ukraine has exacerbated the global gas crisis, which began over a year ago. Europe’s subsequent rush to end its dependence on Russian gas through diversification of supply has pushed gas prices to unprecedented levels.

Without the record 99 TWh of solar electricity generation over the past four months, the EU would have had to purchase an additional 20 bcm of fossil gas. Based on the average daily gas prices for May to August, this equates to avoided gas costs of €29 billion. The year-on-year growth in solar power of 22 TWh alone delivered savings of 4 bcm and over €6 billion.

This contribution from solar is crucial at a time when the security of gas supply has been severely threatened by the curtailment of deliveries from Russia through the Nord Stream I pipeline. The EU is desperately trying to fill gas storage levels to 90% by the end of November, so any additional gas demand over the summer would have had dire consequences for this winter. And from an economic perspective, the last thing EU consumers need is higher energy costs.

Fossil gas prices continued to set their own records over the summer. The European benchmark TTF day ahead price settled at an all-time high of €313/MWh on 29 August and recorded an average of €148/MWh from May to August. This represents a surge of €110/MWh compared with the same period in 2021 when the price was €38/MWh.

The gas price for this coming winter contract (Winter 22/23) is currently nine times higher than it was this time last year at €242/MWh versus €28/MWh.

Due to the uncertainty surrounding the war and the relentless ‘weaponisation’ of gas by Russia, this trend of skyrocketing prices is expected to continue for several years. The TTF forward prices have also reached new highs – with calendar years 2023 and 2024 averaging €129/MWh (+550%) and €87/MWh (+400%) from May to August.

The solar records set this summer helped keep the lights on and reduced the EU’s now critical gas consumption, providing short-term relief to the soaring cost of energy. With skyrocketing fossil gas prices expected to continue for several years, Europe can ease the crisis by urgently stepping up its deployment of solar. This would also be beneficial for the climate – by 2035, our modelling shows that solar would need to achieve as much as ninefold growth to put Europe on a pathway compatible with 1.5C.

Most European countries have already increased their ambition in response to the current crisis. The European Commission’s recent REPowerEU proposal aims to double solar capacity by 2025 compared to 2020 values as part of reaching an updated 45% renewable energy target in 2030. To make sure solar energy keeps bringing benefits to European citizens, it is essential to confirm this new 45% target in the upcoming EU parliament vote on the revised Renewable Energy Directive.

While ambitious targets are critical, their execution is equally important. Solar power is quick to deploy, but barriers prevent its rapid deployment in many European countries. Ember’s recent analysis shows that plans for the upcoming years fall short of what is needed. This is largely due to permitting bottlenecks, with several countries exceeding the legally binding limits of project development times.

Now is the time for Europe to cut the red tape and unleash the power of solar. This is essential not only for climate targets but, perhaps most of all, for the security of the continent and our electricity bills.

Monthly electricity generation is from Ember’s dataset (see methodology and download data), and the EU data is taken from ENTSO-E.

It has been assumed that, due to the costs of producing electricity from gas power plants being the most expensive, any solar power generated replaced gas in the electricity mix. A gas plant efficiency rate of 50% (gross calorific value/higher heating value) has been used. Dutch Title Transfer Facility (TTF) fossil gas prices on 31 August 2022 have been used to calculate gas cost savings. A conversion factor of 1 bcm = 9.7 TWh has been applied.

Sarah Brown, Reynaldo Dizon, Hannah Broadbent, Nicolas Fulghum

Workers installing solar panels in Spain

Credit: July Alcantara