Subsidies for Drax biomass

New data shows Drax received £893m in subsidies for burning forest biomass last year

Table of Contents

About

Drax’s annual report shows that the company earned £893m in government subsidies in 2021 for burning forest biomass. Ember analysis shows this is pushing up UK energy bills, with no guarantee of reducing CO2 emissions.

Drax biomass subsidies

2021 subsidies continue to add to energy bills without clear climate benefit

Last week’s annual report from Drax, Europe’s largest biomass power generator, reveals the scale of the public subsidies the company is receiving. These subsidies push up energy bills, but are not guaranteed to reduce carbon emissions – in fact, Drax is the UK’s single largest CO2 emitter.

In 2021 Drax earned £893m (2020: £832 million) in direct government subsidies for burning forest biomass – more than £2 million a day. These subsidies added £11.60 to the average household energy bill. The company has announced an operating profit of £197 million, alongside a rising dividend to shareholders.

Biomass generation is still considered as carbon neutral in UK law – but a growing weight of scientific evidence has overturned this assumption. The European Academies Sciences Advisory Council (EASAC) now states that using woody biomass for power “is not effective in mitigating climate change and may even increase the risk of dangerous climate change.” The Climate Change Committee recommends the UK moves away from using biomass for power without CCS – and yet biomass use is increasing in the UK power sector, and in 2021 generated 12.8% of UK electricity (12.4% in 2020; 11.6% in 2019).

Direct subsidies to biomass

Drax receives subsidies in the form of ROCs (Renewables Obligation Certificates) and CfDs (Contract for Difference) dependent on the amount of woody biomass it burns. Ember calculates that from 2012 until 2027, when this support runs out, Drax will have collected more than £11 billion in subsidies. This figure is all the more extraordinary considering wind and solar generation, which guarantee real emissions reductions, are now effectively subsidy free.

The biomass carbon tax exemption

Unlike other large thermal generators (e.g. coal and gas), biomass power plants do not pay for their carbon emissions. This is because biomass is assumed to be carbon neutral under the EU Emissions Trading System (and now the UK ETS). That assumption, however, is not supported by the weight of recent science, or by data provided by power plant operators themselves.

More subsidies on the horizon

The government is still considering a further £31.7billion subsidy for biomass with carbon capture and storage (BECCS) at Drax in pursuit of the UK’s net zero emissions goal – where the emissions from burning biomass would be captured and stored under the North Sea. However, as biomass can no longer be assumed to be carbon neutral, more research is needed to understand the true negative emissions BECCS can really offer. The government must only support large-scale BECCS projects when a full life cycle assessment demonstrates they are net carbon negative within a timescale relevant to the Paris Agreement (i.e. a decade).

Other countries, across Europe and in Asia, are looking to the UK’s example on clean energy. Continuing government support for burning forest biomass gives the mistaken impression that it should be part of the electricity transition around the world – but there’s a real risk that more biomass burning will only increase global emissions.

Supporting materials

Methodology

Biomass Sustainability

The Climate Change Committee’s 2018 report Biomass in a low carbon economy contains more information on biomass in the power sector. Key quote: “Most current uses of biomass do not sequester carbon and are in sectors where there are increasingly other viable low carbon alternatives. Current uses of biomass will therefore need to change. Over time, Government policies should assist a transition towards increased use of biomass in construction and BECCS, and away from using biofuels in surface transport, biomass for heating buildings, or biomass for generating power without CCS.” More recently, in January 2022 the CCC’s Head of Carbon Budgets David Joffe told the Parliamentary Environment Audit Committee: “There are big challenges about ensuring the sustainability of biomass grown outside the UK. It’s not impossible but it is very difficult. It’s not something the UK should be relying on at large scale in terms of biomass imports for greenhouse gas removals.”B

Understanding our calculations

- Ember calculation for residential energy bills: Total annual subsidy divided by residential/industrial split of energy bills, divided by number of households

- Ember estimates the value of future subsidies in line with the index they are tagged to: ROC prices increase each year by Retail Price Index (RPI), which currently stands at 7.8%. CfDs increase each year by the Consumer Price Index (CPI), which currently stands at 5.5%

- Drax also has some Scottish hydropower assets, some of which receive ROCs. The amount is not declared in the financial reports but is less than <2.5% of the overall subsidy Drax receives.

- BECCS: Ember’s May 2021 estimate put the cost of BECCS at £181 per MWh in this 2020 research. This is supported by the October 2021 BEIS “Investable commercial frameworks for power BECCS” paper which estimates the price similarly, at £179 per MWh.

- For more information and a detailed methodology behind Ember’s calculations, please read the 2020 report The Burning Question.

Acknowledgements

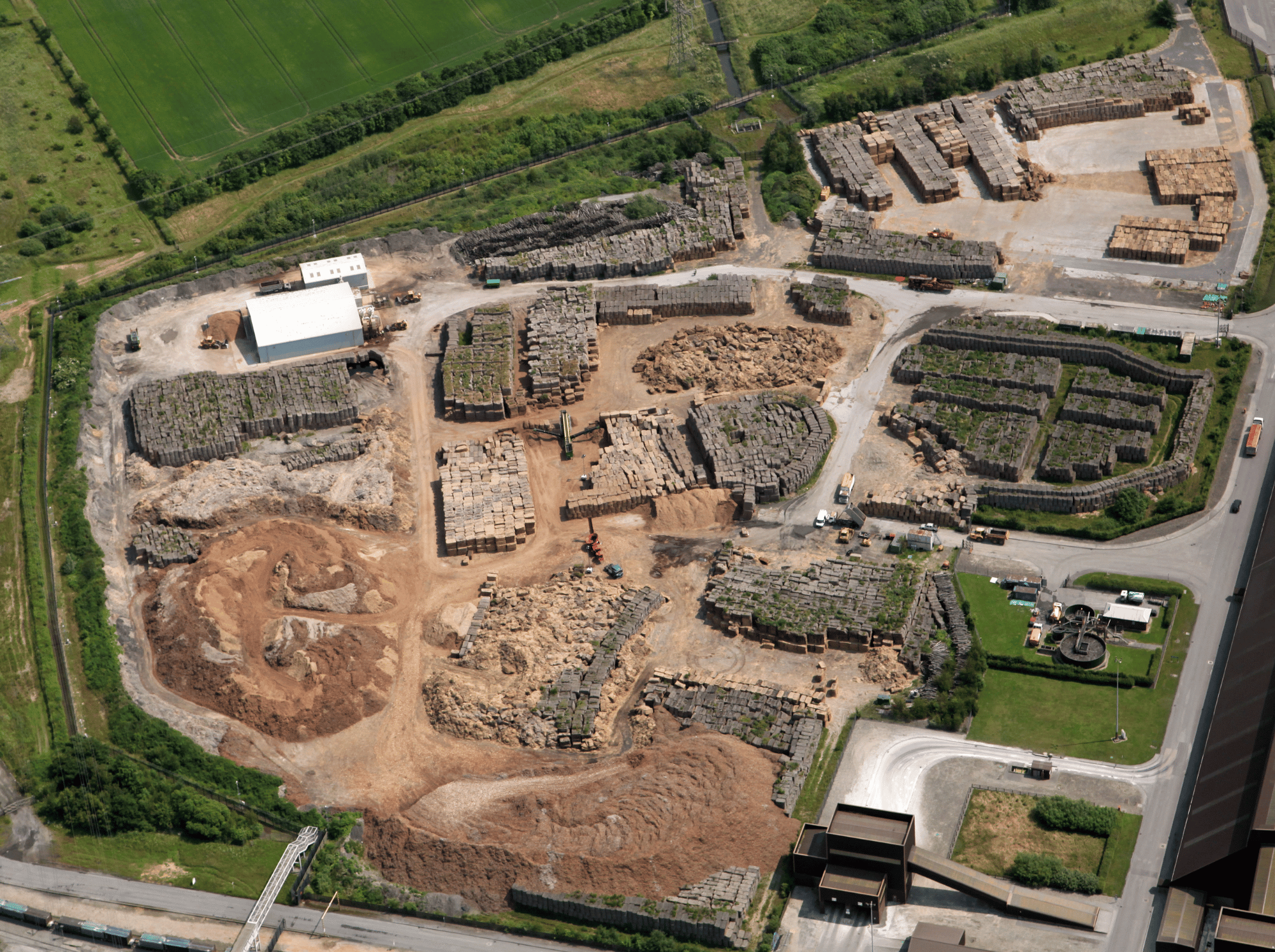

Header Image

A.P.S. (UK) / Alamy Stock Photos

Related Content